Talk to an agent: 888-984-9111

Fast, Reliable Payment Processing for High-Risk Ecom

Get approved fast — with 24/7 support, chargeback protection, and the highest approval ratios in the industry.

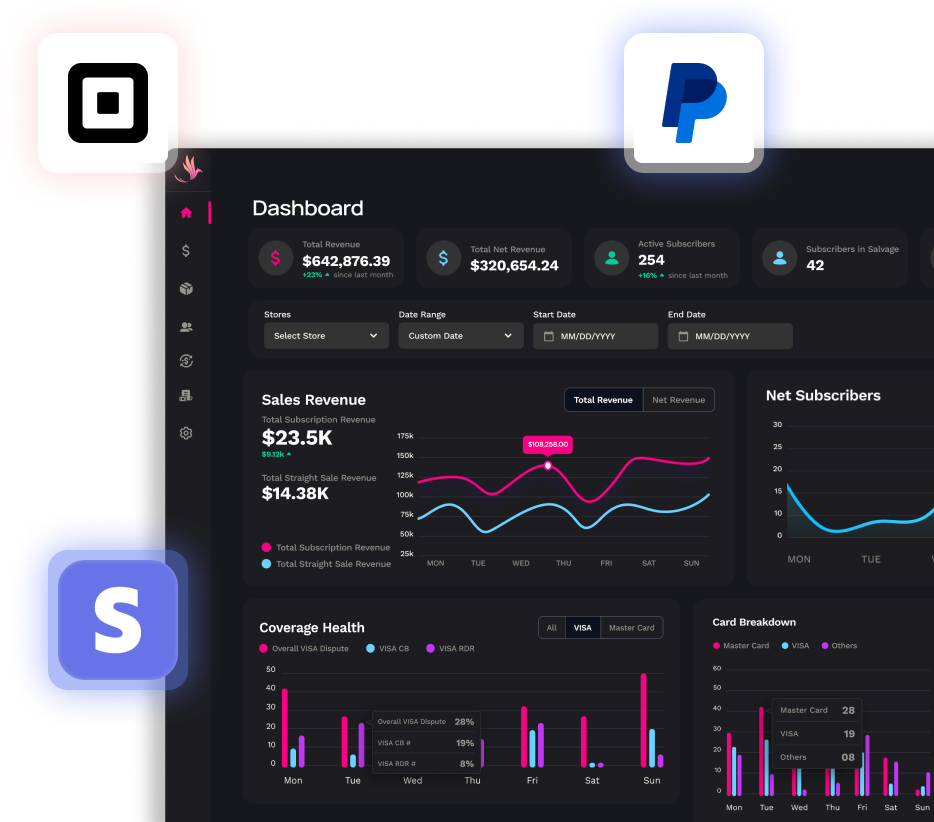

Real-time VAMP Reporting

No Processor Lock-in

Meet or Beat Current Rates

Telegram Support, 24/7

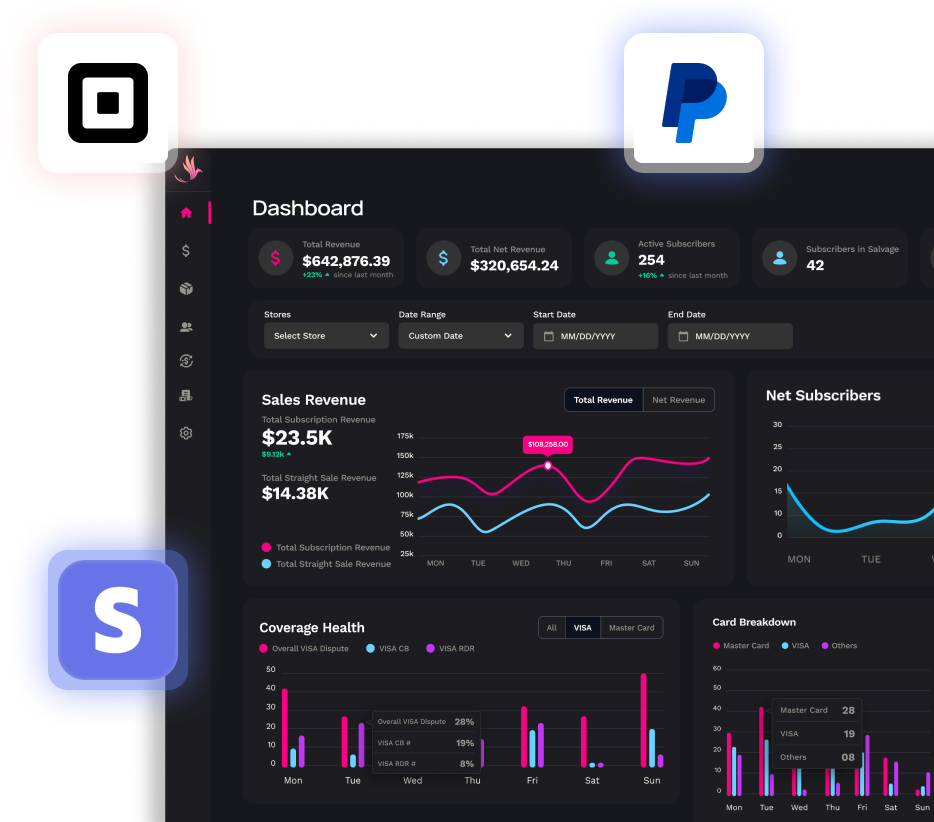

Compatible

Chargeback & MID Health Monitoring

Tech-powered insights, early warnings, MID protection.

Tailored Payments Stack

Leading auth rates, lowest fees, tailored for risk, performance, and cost at the transaction-level.

Ongoing Support & Optimization

Telegram group, payments consulting, performance monitoring.

Phoenix Gateway Setup

Consumer card data ownership. Variety of high risk options for any business type.

Talk to an agent: 888-984-9111

Fast, Reliable Payment Processing for High-Risk Ecom

Get approved fast — with 24/7 support, chargeback protection, and the highest approval ratios in the industry.

Real-time VAMP Reporting

No Processor Lock-In

Meet or Beat Current Rates

Telegram Support, 24/7

Compatible

Chargeback & MID Health Monitoring

Tech-powered insights, early warnings, MID protection.

Tailored Payments Stack

Leading auth rates, lowest fees, tailored for risk, performance, and cost at the transaction-level.

Ongoing Support & Optimization

Telegram group, payments consulting, performance monitoring.

Phoenix Gateway Setup

Consumer card data ownership. Variety of high risk options for any business type.

How it Works

- Pre-vetting Form Submission

Provide your business info to help us qualify your fit.

2. Screening Call with Payments Experts

Personalized consultation to assess your processing needs.

3. Free Merchant Services Checkup

If we cannot meet or beat your current rates, receive a $500 VISA gift card.

4. Payment Gateway Setup

Your merchant account is approved, and your gateway credentials are delivered. You own your data, not the processor.

5. Chargeback Prevention Program Enrolled

Stay protected with proactive chargeback monitoring and prevention tools.

6. Ongoing MID Health Monitoring

We continue to monitor, support, and optimize your payment stack while you grow.

How it Works

- Pre-vetting Form Submission

Provide your business info to help us qualify your fit.

2. Screening Call with Payments Experts

Personalized consultation to assess your processing needs.

3. Free Merchant Services Checkup

If we cannot meet or beat your current rates, receive a $500 VISA gift card.

Your Payment Stack, Upgraded

Phoenix Payments as Your Merchant Processing Partner

Phoenix Payments was built by operators who’ve scaled 8- and 9-figure D2C brands — we know firsthand the pain of processor shutdowns, low approval rates, and endless disputes.

That’s why we designed a payments solution engineered for performance-driven merchants. Phoenix offers proactive chargeback prevention, MID health monitoring, and processor-agnostic flexibility — so your revenue keeps flowing, no matter what.

By combining elite technology with hands-on operator support, Phoenix has become the trusted partner for top ecom brands across the U.S. We help you maximize approvals, protect margins, and keep ownership of your customer data.

Get approved fast. Start processing smarter. Scale without fear.

Your Payment Stack, Upgraded

Phoenix Payments as Your Merchant Processing Partner

Phoenix Payments was built by operators who’ve scaled 8- and 9-figure D2C brands — we know firsthand the pain of processor shutdowns, low approval rates, and endless disputes.

That’s why we designed a payments solution engineered for performance-driven merchants. Phoenix offers proactive chargeback prevention, MID health monitoring, and processor-agnostic flexibility — so your revenue keeps flowing, no matter what.

By combining elite technology with hands-on operator support, Phoenix has become the trusted partner for top ecom brands across the U.S. We help you maximize approvals, protect margins, and keep ownership of your customer data.

Get approved fast. Start processing smarter. Scale without fear.

High Risk Merchants We Serve

Ecommerce

Merchant Account

Adult

Merchant Account

Furniture

Merchant Account

Firearm

Merchant Account

Subscription

Merchant Account

Nutraceuticals

Merchant Account

Dropshipping

Merchant Account

Ticket Brokers

Merchant Account

CBD

Merchant Account

Travel

Merchant Account

High Volume

Merchant Account

MLM

Merchant Account

High Risk Merchants We Serve

Ecommerce

Merchant Account

Bad Credit

Merchant Account

Adult

Merchant Account

Firearm

Merchant Account

Subscription

Merchant Account

Dropshipping

Merchant Account

Online Pharmacy

Merchant Account

Credit Repair

Merchant Account

CBD

Merchant Account

MLM

Merchant Account

Travel

Merchant Account

High Volume

Merchant Account

Dating App

Merchant Account

Startups

Merchant Account

Ticket Brokers

Merchant Account

Debt Collection

Merchant Account

High Risk Merchants We Serve

Ecommerce

Merchant Account

Adult

Merchant Account

Firearm

Merchant Account

Subscription

Merchant Account

Dropshipping

Merchant Account

Nutraceuticals

Merchant Account

CBD

Merchant Account

MLM

Merchant Account

Travel

Merchant Account

High Volume

Merchant Account

Furniture

Merchant Account

Ticket Brokers

Merchant Account

How to Know if Your Brand is Considered High-Risk

Every payment processor defines “high-risk” differently, but the flags are usually the same:

- Fraud & Chargeback Rates → Too high and you’re automatically labeled risky.

- Industry Category → Supplements, digital memberships, coaching, and more are often flagged.

- Reputation & Credit Profile → Even past issues can hurt current approvals.

The result? Low auth rates, higher fees, or sudden MID shutdowns.

Phoenix Payments was built to keep high-risk merchants processing safely — with MID monitoring, chargeback prevention, and processor flexibility that most providers can’t match.

How to Know if Your Brand is Considered High-Risk

Every payment processor defines “high-risk” differently, but the flags are usually the same:

- Fraud & Chargeback Rates → Too high and you’re automatically labeled risky.

- Industry Category → Supplements, digital memberships, coaching, and more are often flagged.

- Reputation & Credit Profile → Even past issues can hurt current approvals.

The result? Low auth rates, higher fees, or sudden MID shutdowns.

Phoenix Payments was built to keep high-risk merchants processing safely — with MID monitoring, chargeback prevention, and processor flexibility that most providers can’t match.

Can I Use Stripe, PayPal, or Square if I’m High-Risk?

The truth: no mainstream processor will reliably support high-risk merchants.

Stripe, PayPal, and Square are built for “safe” businesses. If you sell supplements, memberships, digital products, or anything considered “high-risk,” you’re at risk of:

❌ Sudden account freezes

❌ MID shutdowns without warning

❌ Funds held for months

Phoenix Payments exists so you don’t get blindsided. We give you direct acquirer relationships, proactive MID health monitoring, and processor flexibility — so you can scale without fear of being cut off.

Can I Use Stripe, PayPal, or Square if I’m High-Risk?

The truth: no mainstream processor will reliably support high-risk merchants.

Stripe, PayPal, and Square are built for “safe” businesses. If you sell supplements, memberships, digital products, or anything considered “high-risk,” you’re at risk of:

❌ Sudden account freezes

❌ MID shutdowns without warning

❌ Funds held for months

Phoenix Payments exists so you don’t get blindsided. We give you direct acquirer relationships, proactive MID health monitoring, and processor flexibility — so you can scale without fear of being cut off.